5 Best Crypto Scalping Indicators

Scalping is a trading strategy characterized by making many trades over short periods. Scalping is one of the most popular strategies for day-trading cryptocurrencies because it presents opportunities for high returns with relatively low risk.

Traders use crypto scalping indicators to find small price movements in the market and take advantage of these fluctuations by opening positions to capitalize on small movements in their favour, and typically are in and out of positions quickly. In this article, Coin Hint experts will explain the best scalping indicators for crypto and give tips for starting with scalp trading.

What is Scalp Trading in Crypto?

So, what is crypto scalping? Scalp trading involves taking small profits from small price movements in crypto assets. Traders use a combination of technical indicators and price data to identify these small movements, quickly open positions, and close them just as quickly for a profit, rather than holding for a bigger move.

This strategy can work well particularly because cryptocurrencies are highly volatile, so there will probably be a slight price movement that can be exploited if you are quick enough. The profits from scalping may initially be small as you are usually only capturing a few pips, but they do add up over time, especially if trades are executed quickly during periods of high market volatility.

Crypto scalpers typically purchase crypto assets at lower prices and sell them at higher prices, making money on the price differences. This strategy is ideal for short-term traders that have time to monitor markets in real time as they can take advantage of small price movements over minutes or hours rather than days or weeks.

How Does Scalp Trading Work?

Here are the most used scalping strategies among crypto traders:

1. Crypto Range Trading

Range refers to the movement in price between highest and lowest price levels over time. Crypto range traders tend to go long near the range lows and short at the range highs based on a reversion expectation that the range will remain intact.

2. Bid-Ask Spread

The bid-ask spread is the difference between an asset’s asking (buying) price and the bid (selling) price. Scalpers open a position at the bid or ask price and then close it quickly by a little lower or higher to profit once the spread is exceeded by the move. It is important to note that in modern markets, this is not a viable trading strategy.

3. Arbitrage Strategy

A trader earns money through arbitrage by buying and selling the same asset in different markets/venues at differential prices simultaneously. This can be a particularly challenging strategy to implement but has been possible in crypto markets as they are decentralized. A fast server and good trading technology is required to successfully execute an arbitrage trading strategy in the crypto market.

What are the Best Indicators for Scalping Cryptocurrency?

Here are some of the best technical price indicators for scalping crypto, with explanations as to how they are used in cryptocurrency scalping:

The SMA Indicator

The Simple Moving Average (SMA) is a way to calculate the average price of a cryptocurrency over time.

The SMA is an indicator that considers all prices equal to find the actual average price. This allows investors to have more accurate information. Furthermore, the SMA indicator changes its position as soon as a new price candle appears on the chart.

The Bitcoin/USD daily price chart below includes a 200-day SMA in blue. The line has steadily descended, and all the price action is below it, indicating a clear long-term downwards trend.

The EMA Indicator

The Exponential Moving Average (EMA) is like the SMA. Both follow a trend’s progression. The main difference is that the EMA uses a more complex calculation to place greater weight on recent price changes. Thus, an EMA can be a better short-term indicator when there are sudden price fluctuations.

EMAs are best for traders who do not plan to keep a position open for a long time. The most effective strategy is to use a combination of both the SMA and EMA to get short and long-term price indications simultaneously.

The Bitcoin/USD daily price chart below includes a 21-day EMA in green. Note how the periods of strongest bearish momentum have tended to happen when the price action is below the EMA.

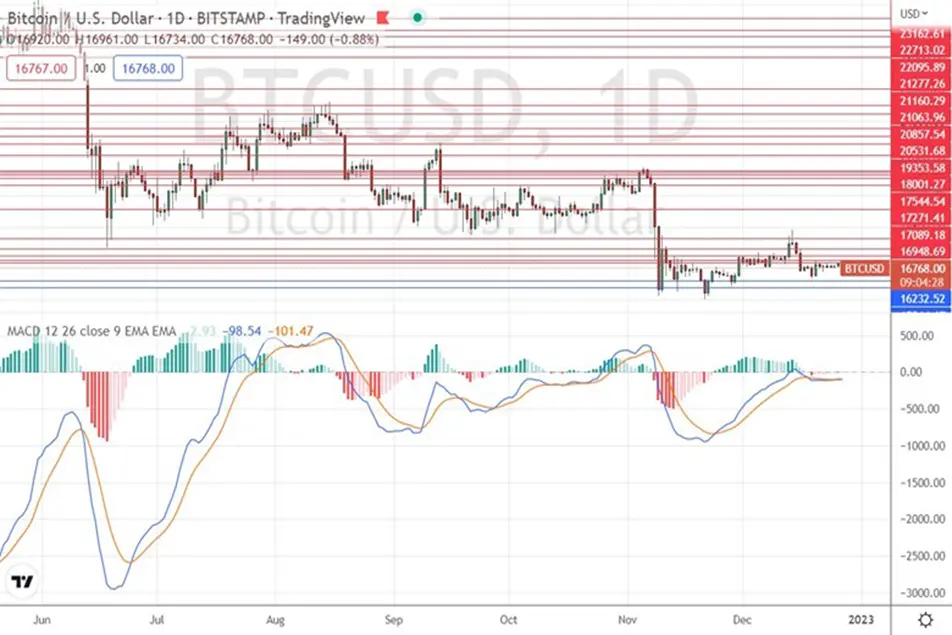

The MACD Indicator

The Moving Average Convergence Divergence (MACD) indicator shows data derived from two moving averages calculated by subtracting the 26-day EMA from the 12-day EMA, with the 9-day EMA set as the default signal line marking buy or sell triggers.

It is a momentum indicator and one of the most used in scalp trading, as it helps traders identify the market’s directional bias to make profitable trades. Convergence and divergence refer to the points during which the 12 and 26-day EMA’s move closer or further apart.

The MACD is a lagging indicator.

The Bitcoin/USD daily price chart below includes a MACD histogram below the price chart. Note how the periods of strongest bearish momentum have tended to happen when the histogram is red, within the longer-term bearish trend.

The Parabolic SAR Indicator

The Parabolic Stop and Reverse, (SAR) is an indicator that verifies price action trends. It is normally used during a trend to determine trend direction and to draw a level candle by candle which would indicate the trend has ended – this level is often used as a stop loss.

The SAR indicator is most effective in markets that are currently trending.

The Bitcoin/USD daily price chart below includes the Parabolic SAR indicator imposed upon the price chart. Note how using the upper dots as stop losses could have indicated when bearish momentum was strong.

The Stochastic Oscillator Indicator

The Stochastic Oscillator indicator is one of the most popular scalping indicators because it is a leading indicator, giving traders signals of a potential price movement before it happens.

The indicator gauges how the closing price measures up to the given price range over a set period. If it shows a value above 80, that means the market is currently seeing prices higher than average and might be due for a dip soon. Any value below 20 signals that some good buying opportunities might come up, as spent demand starts to recharge.

The stochastic oscillator can be used to find potential entry and exit points when trading or scalping the markets. Scalpers can look for short-term selling opportunities when the indicator is overbought, or short-term buying opportunities when the indicator is suggesting a market is oversold.

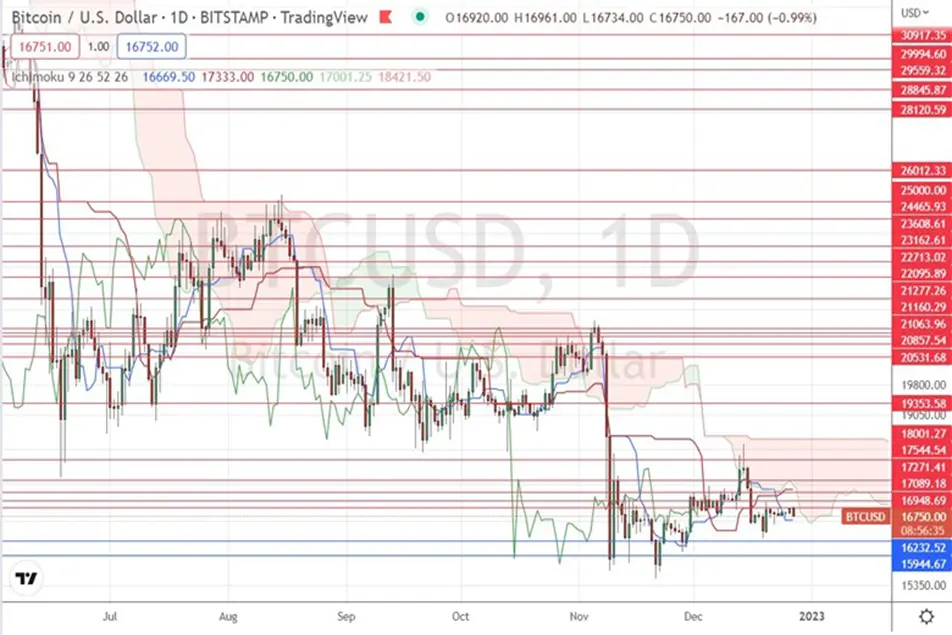

The Ichimoku Cloud Indicator

The Ichimoku cloud is used as a tool to signal potential trend reversals. This occurs when the current price is monitored against its 26-period and 52-period moving averages. By plotting an EMA (Exponential Moving Average) and IMA (Implied Moving Average), a histogram can identify trends by showing when prices are above or below their averages.

Ichimoku Cloud values are calculated using not just the most recent closing price, but also by evaluating a set amount of recent prices – the default values for the indicator are usually 9 for the Conversion Line (Tenkan-sen), 26 for the Base Line (Kyun-sen), and 52 for the Leading Span B (Senkou Span B). This also allows for the identification of trend reversals by displaying new highs or lows in relation to these given averages.

The Bitcoin/USD daily price chart below includes an Ichimoku Cloud imposed upon the price chart. Note how the periods of strongest bearish momentum have tended to happen when the price action is below the cloud, within the longer-term bearish trend.

How is Scalping Different in Crypto?

Compared to other asset classes like Forex and stocks, crypto markets can be far more subject to volatility and wider spreads, which means that it is more difficult for scalpers to take advantage of short term buy and sell opportunities. This is because crossing the bid-ask spread tends to be much more significant in the cryptocurrency market than in other asset classes.

However, some traders argue that the wider spread is necessary because cryptocurrency markets are more prone to price manipulation and extreme volatility. Given this volatility, scalp trading becomes more viable as there are more opportunities for price movement.

If you are looking for a mix of volatility and reliability in your trading, many recommend scalping Bitcoin (BTC). If you are planning to scalp trade with altcoins, make sure to pick ones that have relatively high liquidity. When scalping in the cryptocurrency market, I stress the importance of having an exit strategy and sticking to your plan. This way, you can minimize losses and maximize profits.

How Does Scalp Trading Generate Profit?

When using scalping strategies to take profits, traders are typically looking for very short-term opportunities to make a quick profit with minimal risk exposure.

To scalp effectively, it is essential to have a solid understanding of technical analysis and the ability to identify short-term trends. Scalpers will typically monitor a cryptocurrency for these signals, then act quickly once a signal is spotted.

The key to successful scalping is having good timing and discipline. If you can successfully analyze price action and spot potential entry and exit opportunities, you can make consistent profits from this strategy. Note that a successful scalping strategy requires patience and discipline, but the financial rewards can be considerable if you are skilled at this type of trading.

It is also important to have a flexible and adaptive approach. Many call it “gut feeling”, but experienced successful traders can read the charts and identify trading opportunities by looking at key technical price indicators and recognizing momentum.

Best Time Frame for Scalping

One of the most crucial factors to consider when scalp trading is the desired time frame. Scalpers prefer short-term opportunities, so it is best to keep your time frame small.

For instance, you might want to use a 5-minute timeframe or even the 1-minute timeframe. A scalper’s primary goal is to achieve a large number of profitable trades.

Some traders swear by 1-minute charts for fast intraday trades. The rationale behind this is that this timeframe provides the most recent pricing information, allowing scalp traders to make quick profits. However, shorter timeframes also require traders to identify price action and chart patterns in a matter of seconds or minutes. So, it is still up to your skills, instincts, and preferences when choosing a timeframe.

The ideal scalp trading time frame for you is determined by your personal preference. It is generally a good idea to look at several charts at once, including the 1-minute chart and either the 5-minute or 15-minute charts also.

Scalping Tips

Before you engage in cryptocurrency scalping, here are some helpful tips:

Open a Demo Account

Gaining user experience with trading tools is especially important for first-time traders. A crypto demo account or scalping tutorial can help you start. You can watch the market and make simulated trades with a demo account with virtual money to get familiar with the strategy.

Learn Technical Analysis

Technical analysis is an essential skill for successful scalpers, so it is important to be familiar with price charts and key indicators such as moving averages, RSI, Bollinger bands, and candlestick patterns. You can reference online resources and trading forums to learn more about technical analysis.

Practice With a Small Initial Investment

Before jumping into the world of cryptocurrencies and making your first trades, it is a good idea to practice with small amounts of money to limit your risk exposure. You should also use a demo account to practice scalp trading first before moving onto real money.

Conclusions

When setting up your scalping strategy, a few things to consider are:

- the indicators you will use to make trading decisions

- how many simultaneously open orders fit your trading style and time you have available

- what times of day offer the most liquidity and are convenient for you to trade – scalpers usually want to be trading during periods of high liquidity

With so many crypto indicators available, selecting the ones that conform to your trading style and provide you with critical information is vital. The indicators discussed above are the most popular and widely used in the crypto trading community.

When considering how you will manage your risk, it is important to note that scalping is a high-risk trade. By using stop-loss orders, you can usually ensure that you will not lose more than a certain amount if the trade goes against you, but it is very possible to get slippage and lose even more, especially if you are trading an illiquid market such as a typical altcoin for example.

FAQ

-

Which indicator is best for crypto scalping?

The EMA indicator is one of the best scalping indicators due to its responsive nature to recent price changes.

-

What is the most accurate indicator for scalping crypto?

The RSI is considered a very accurate indicator for scalping cryptocurrency, as it can help you assess overbought and oversold price movements.

-

What should I look for when scalping crypto?

Among the things to look for when scalping crypto are choice of coin, the right trading platform, and the best strategies for your trading style.

-

Which cryptocurrency is best for scalping?

The most liquid cryptocurrencies are widely considered to be best for scalping, such as Bitcoin and Ethereum.