The Evolution of NFTs: How Non-Fungible Tokens Have Evolved Overtime

This guide to the history and future of the NFT market explores the stages through which non-fungible tokens (NFTs) have developed, from their creation to the multi-billion market they represent today. It also discusses the milestones and future of NFTs, as well as the development directions in the market today.

What Are NFTs?

Non-fungible tokens (NFTs) are digital tokens with a distinguishable value from any other token used to signal ownership of an object or digital asset on the blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum, which can be traded interchangeably, NFTs cannot be substituted by another asset.

Understanding Non-fungible Tokens

NFTs are digital tokens that, by employing blockchain technology, make it possible to establish digital provenance. In simple terms, when an NFT is minted, it gets a serial number on the blockchain that makes it different from all other tokens. This identifier includes information about the asset, its owner, and any other attributes associated with it.

This is why NFTs are a good fit for digitizing art, collectibles, claimable virtual plots of land, and other items. Acquiring or purchasing an NFT means that someone buys the license to that unit on the blockchain, which acts as proof of ownership and of the originality of the digital asset in question.

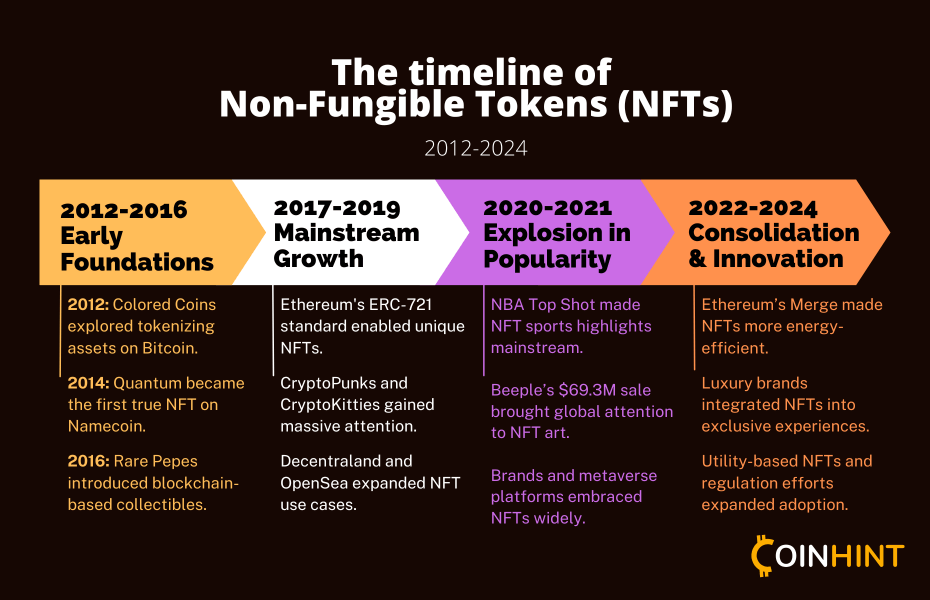

What Is the History of NFTs? – The Early Days of NFTs

The origin of NFTs can be traced back to 2012 when the idea of “Colored Coins” appeared on the Bitcoin network. These were supposed to be equivalent to real-world assets, but they weren’t very usable because of Bitcoin’s inherent design.

In 2014, the project “Counterparty” was initiated on Bitcoin, enabling users to create and trade custom assets. This led to the creation of meme trading cards and other early forms of digital collectibles.

However, today’s ‘actual’ NFTs were advanced in 2017 with the launch of CryptoKitties on the Ethereum platform. This game, in which users could not only breed cats but also trade NFTs, such as the cats’ eggs, became so popular that it overburdened the Ethereum network’s capacity, proving the strength of the NFT industry to date.

Key Phrases in NFT Evolution

The Rise of Ethereum and the ERC-721 Standard

In 2018, the ERC-721 standard was created in response to the launch of CryptoKitties. This standard outlined how an NFT should work on the Ethereum blockchain, giving a structure for creating and managing singular tokens. This standard was essential in contributing to the development of differentiated NFT projects and platforms.

The NFT Boom of 2020-2021

Interest in NTFs and associated art expanded vastly during the 2020 and 2021 bull market. This period saw record-breaking sales, such as Beeple’s “Everydays: The First 5000 Days,” which was sold at Christie’s auction house for $69 million. Several factors led to the boom, including better coverage of NFT projects in the mainstream media, endorsement of NFT projects by celebrities and the involvement of traditional auction houses in the field.

At this time, NFT marketplaces such as OpenSea, Rarible, and Nifty Gateway became popular, and P2P NFT trading amounted to billions of dollars. During the same year, games such as Axie Infinity popularised the play-to-earn (P2E) model in the games industry using NFT technology.

NFTs Use Cases

As the technology evolved, NFTs found applications beyond digital art and collectibles, including:

- Gaming: NFTs are used for in-game items, characters, and virtual real estate

- Music: Concert tickets, fan experiences and album releases

- Sports: Trading cards and even some fan tokens

- Real Estate: Virtual land and property ownership tokenization

- Identity and Certification: Licenses, digital identities and academic credentials

- Supply Chain: The authenticity of products, which includes tracking and verification

Issues and Challenges of the NFT Market

Despite its rapid growth, the NFT market has faced several challenges:

- Environmental Concerns: The energy consumption of blockchain networks, particularly Ethereum, has raised environmental concerns.

- Market Volatility: NFT prices can be highly volatile, leading to significant financial risks for investors.

- Copyright and Intellectual Property Issues: The ease of minting NFTs has led to instances of copyright infringement and unauthorized tokenization of artworks.

- Scams and Fraud: The NFT space has seen numerous scams, including wash trading and rug pulls.

- Lack of Regulation: The absence of clear regulatory frameworks has created uncertainty in the NFT market.

How Do NFTs Increase in Value Over Time?

The value of NFTs can appreciate over time due to several factors:

- Scarcity: These artworks are open to a limited number of viewers or are uniquely created and tend to appreciate because of their scarcity.

- Artist or Creator Reputation: As the artist or brand increases in popularity, their NFTs will increase in value.

- Historical Significance: NFTs, like other important milestones or ‘firsts’ in the crypto world, can increase in value due to their role in the historical development of crypto and the blockchain.

- Utility: Those with rewards that are delivered frequently or that grant the holder exposure to some form of content or service rise as the undertakings tied to them advance.

- Market Demand: Most traders have seen overall interest in an NFT market or specific collections that are now higher.

- Community and Network Effects: Several indications suggest that it can be sustained or grown—established and engaged communities around particular projects.

However, bear in mind that not all NFTs have appreciated, as the market is not overly speculative.

The Future of NFTs

NFTs Regulations

As its activity develops, the market for NFTs is also attracting the attention of global regulating authorities. Possible areas of relevance include copyright, Anti-Money Laundering, and consumer protection. A clearer regulation could add more solidity to the legitimacy of the NFT market, thus increasing adoption.

Technological Innovation in NFTs

Technological advancements are set to enhance the functionality and efficiency of NFTs:

- Layer 2 Solutions: Current integrations, including Polygon and Immutable X, are working toward eliminating scalability challenges and lowering gas fees and carbon footprint.

- Interoperability: Current projects are developing approaches to making NFTs portable across different blockchains, enhancing their applicability and circulation.

- Fractional Ownership: This allows many investors to afford shares of the high-priced NFTs since they have been broken down.

- Dynamic NFTs: These are tokens that may be modified to reflect other data or situations, which can further enrich the opportunities for an interactive and constantly developing digital asset.

The Role of NFTs in Web 3.0

Here at CoinHint, our analysts project that NFTs will play a crucial role in the development of Web 3.0:

- Digital Identity: NFTs could be used as personal digital credentials, which would let people be in control of their data.

- Metaverse Integration: As noted above, NFTs may be expected to hold a core position in ownership and use, as well as negotiations and trades in virtual worlds and the metaverse.

- Decentralized finance (DeFi) Integration: NFTs could secure loans or be employed in any kind of DeFi project.

- Tokenization of Real-World Assets: An example of digital and physical economies is that the same may be used to represent the ownership of real products in the physical economy of a country.

Conclusion

NFTs started as simple digital tokens, but the momentum behind them has been fast and forceful, propelling them into a market that is now probably measured in the many billions of dollars. Challenges remain, but technology keeps on evolving and adapting new applications, tremendously changing the limit of digital ownership and value transfer.

As the digital world moves towards a more decentralized and digital future, NFTs will probably have an even bigger role in how we engage with digital content, ownership, and participation in the digital economy. Nevertheless, the short-term success of NFTs will be contingent on resolving challenges related to sustainability, regulatory compliance, and mainstream adoption.

NFTs are far from finished; the next few years will bring even more innovations to this space. For an artist, investor, technologist, or anyone curious about the future of digital assets, there’s lots to watch and participate in within the evolving space of NFTs.

FAQ

-

How did NFTs become so popular?

NFTs gained popularity due to a combination of factors. These include the rarity of tokens, the ability to protect copyright on digital products, record the ownership of digital resources, and large-scale sales of tokens through the media and the fastest growing interest of the population in cryptocurrencies and blockchain systems.

-

What are the main use cases of NFTs?

The main applicational areas of using NFTs are art, collectibles, video games, copyrights, concerts, tickets, real estate, and credentials.

-

Why are some NFTs so expensive?

Some NFTs are expensive because they are rare, or because of who made them, their origin, and the perceived value or prestige associated with owning a particular kind of token. For this reason, there is heightened speculation concerning the market, which is exerting some pressure on the prices of some NFTs.

-

Are NFTs losing value?

The expansion trend of the NFT market has experienced rising and falling cycles. Not every artwork has decreased in value; some have remained stable or even appreciated. These fluctuations are, therefore, justified by the fact that the market is relatively new and speculative.

-

How can I create and sell my own NFT?

To create and sell an NFT, you typically need to:

- Select a blockchain (for example, Ethereum)

- Set up a digital wallet

- Choose an NFT platform; it could be OpenSea or Rarible etc.

- Create your digital asset

- Prepare the chosen platform for minting the NFT

- Market it on the market for sale

-

What are the effects of NFTs on the environment?

Most of NFTs’ environmental impact can be attributed to the energy consumption of blockchains, specifically, PoW consensus algorithms. Nevertheless, there are technologies to address these concerns in the industry through energy-efficient blockchains and carbon compensation (Frederick, 2018).